Unit Twelve

RESOURCES

STAY IN TOUCH

Phone: 1300 960 136

Address: Hope Island QLD 4212

MEMBER DETAILS

PROUD SUPPORTERS OF

The Flow of Money

Purpose

Understand financial management and budgets in a franchise

Develop budgets for both the franchisee and franchisor

Work out the fee structure for the franchise group

Review how this will impact on the structure of the group overall

Actions

Action 1: Understand the flow of money in a franchise group

Action 2: Complete the Set-up cost and Marketing and other Contribution Fund Schedules

Action 3: Prepare actual accounts for your existing business

Action 4: Prepare anticipated budgets for your existing business, the model franchisee business and your franchisor business and in the process, set up the fee structure for the franchise

Action 5: Prepare a Budgeted Balance Sheet

Action 6: Extend the Budgets over three to five years

Action 7: Review how this will impact on the structure of the group overall

Guide

Supporting Material

PDF Version

Action 1 – Understand the flow of money in a franchise group

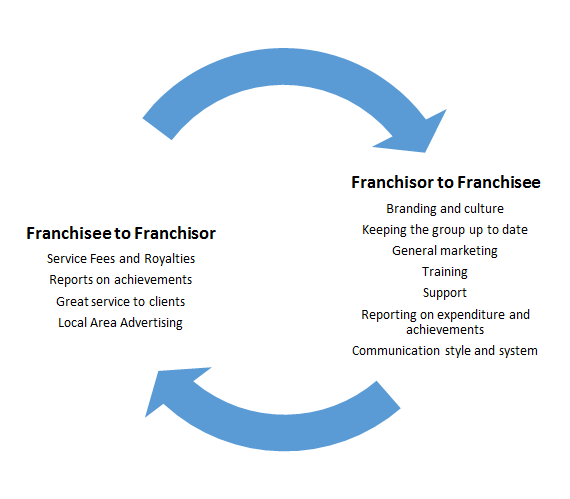

The flow of money

In any franchise group it is the franchisee which generates the turnover to support both the franchisee business and your franchisor business and any additional levels such as State or Regional Franchisors. You, the franchisor supply goods and or services in return for the money.

There is a saying that ‘Profitable Franchisees are happy Franchisees’, and you need to make sure that the whole business is structured so that both you as franchisor, and your franchisees, are happy and profitable for the long term.

Listen to this Radio Show interview with Peter Knight which sets the scene for what can be a tricky topic.

The franchisor business will need income to cover:

- Expenses to run the franchisor business including a salary for the franchisor and, as the business becomes bigger, salary for other employees and consultants

- Franchisor’s contribution to co-operative funds such as marketing, research and development

- Expenses to cover provision of other services for the franchisees (some will provide bookkeeping or product)

Reasonable profit for the franchisor

The franchisee business will need income to cover:

- Expenses including a salary for the franchisee and staff

- On-going fees and services to be paid to the franchisor

- Reasonable profit for the franchisee

Make sure the franchisor business is viable in the long term

Franchisor income comes from a number of franchisee sources:

- Sales of the franchise outlets

- Service fees and royalties

- Sales of product

- Training Fees

- Renewals and transfers

- Contributions to cooperative funds such as the Marketing Fund

The thing is, once all the franchise territories have been taken up, sales income will substantially reduce. Good franchises do not change hands very often.

So, you need to make sure your franchisor business is viable without any ongoing sales income. The royalties, service fees, product sales and contributions all need to be able to support expenses and reasonable profit for the franchisor in the long term. This way, once the sales income dries up, the franchise group does not dry up too.

Plan for growth and the need for staff

At the beginning, you the franchisor will probably take on many tasks in your part of the organization. But as the number of franchisees increases, you will need to leverage yourself out of the tasks and will need to employ staff or hire contractors to undertake tasks. The same will apply to your franchisees.

Bookkeeping, for instance, is something you may be doing now but as business increases and as it becomes more complex with the different budgets to manage, you will need a bookkeeping service to handle these tasks.

As you go through the budgets in this Unit, remember this flow of money and the need to think about who generates the money and there needs to be enough to support both sides of the business as it grows and staff become involved.

Not thinking carefully about the money up front is one of the main reasons franchise groups go wrong. It is all too easy not to plan carefully enough for your side of the business to provide the services needed by your franchisees. And it is all too easy to overlook franchisee expectations about the level of service they require and the amount of profit they need to stay happy.

It is virtually impossible to change the fee structure once your franchisees are in place. So, this is something you need to get reasonably right before your franchise business starts. And working these out starts with the budgets.

Take care with the budgets and the flow of money.

The need for continual review

The first cut of these budgets will not be accurate.

As you go through the Units, you will find there are things you have overlooked or were not aware of. This particularly applies to the franchisor business because you will not have operated a business such as this before. It is easy to overlook issues which later become important.

So continually review the budgets you prepare as you put the business together.

This continual review will never end as the business develops. The last Unit in this program covers the budgets you and your franchisees will need to examine weekly, monthly and annually if you are to keep your hands on the way your business is going.

The budgets

Understand how the budgets work

If you have never used profit and loss accounts and cashflow to work out the feasibility of a business and you are not familiar with this level of budgeting, then start by learning.

This knowledge is essential to any business owner and if you are to grow, you need to use these tools regularly. There are many books and courses available. If you don’t have time to study accounting in detail, I strongly recommend a terrific, simple book ‘Unfunk your business finance’ by Scott Trerethan.

In this Unit you need to prepare budgets and cashflows and review them regularly, especially in the early stages, in order to track the accuracy of your projections.

It’s not only about profit – a growing business can easily run short of cash and face financial ruin. So make sure you maintain this vital snapshot of your business and evaluate it regularly. The Workshop video where Rob McAdam of McAdam Siemon discusses budgets and cashflow is a good start.

Use expert help and if you want to know more, contact Brian Keen to discuss the options for working with his expert franchise accounting team.

The financial planning of your new business is not to be taken lightly so we strongly recommend, once you or your bookkeeper have prepared your budgets, you discuss them closely with a trusted accountant and tax adviser.

It is also strongly recommended you get advice from a good franchise mentor. You need to be sure your model works and you’re not going to have any surprises with either your cashflow or with demands from the taxman.

You will incur an expense here but avoid this vital step at your peril.

Action 2: Complete the Set Up Cost and Marketing and other Contribution Fund Schedules

You need this information to feed into your budgets for each tier of your franchise group.

Understand Contribution Funds and how they relate with each other

You need to work out how marketing undertaken by the franchisor will be funded.

Co-operative Funds can be created to cover many issues.

Most franchise groups will have a Marketing Fund. This is a Co-operative Fund, controlled or administered by the franchisor but which can be inspected by the franchisees under terms set out in the Disclosure Document.

Many franchise groups will also need to take contributions to cover other co-operative work done that benefits the whole group.

Example are the service funds needed more and more often today for managing software and other tasks which control administrative tasks across the whole group.

Many franchise groups use the one Marketing Fund to manage both the marketing and administration funds but this can become messy to manage. So, I generally recommend you establish at least two Co-operative Funds, one for administering the service fees your franchisees will pay towards things such as central software and one as the Marketing Fund.

The key thing to remember is –

The rules governing all Co-operative Funds must be transparent at the time the franchisee signs the documents.

This notional excerpt from a Disclosure Document outlines how the Marketing Fund can be specified in your legal documents.

And refer to the list of some suggested fees and royalties.

Determine what will be included in Marketing Fund

The Marketing Fund

The Marketing Fund covers all franchisee relevant marketing undertaken by the franchisor.

The Marketing Co-operative Fund is controlled or administered by the franchisor but can be inspected by the franchisees under terms set out in the Disclosure Document.

The money in the Marketing Fund is usually contributed by both the franchisor and the franchisees in accordance with who benefits from each activity and what is set out in the Disclosure Document.

The franchisor makes contributions to cover any company owned outlets and any work done which will benefit them. (Proportion of a website which also advertises for franchise recruitment for instance).

It goes without saying, the Marketing Fund can be the source of significant argument between the franchisors and franchisees if the marketing work and contributions are not clearly stated at the outset. It is in your best interests to be as clear as possible from the beginning on what will be done by whom, at what cost and who will pay.

The costs for keeping the Marketing Strategy, Brand Plan, Advertising Schedules up to date all need to be added, as well as the ongoing costs associated with any form of promotion.

At the end of the process, you will have a great idea of how much it will cost for promoting your product and who will be responsible.

Add ongoing marketing costs to the Product Marketing Schedule

The Marketing Plan has a Marketing Schedule attached. The Marketing Schedule is an excel budget showing the distribution of funds needed to run marketing over the next 12 months. What goes where will have been worked out in principle in your Marketing Plan for the Franchise Group for the year in Unit 11.

The excel version of a notional Product Marketing Schedule available through the Members’ Area will help.

As you can see, there are sections for:

- The costs your franchisees and each company store will bear for any Local Area Marketing they are expected to incur to promote their own business

- The costs you, as franchisor, will bear for promoting your franchisees’ businesses

- The costs you, as franchisor, will need to control and maintain central aspects such as:

- Product Marketing Strategy

- Brand Profile Development

- The website

- Managing social media

- Advertising specifications

- Printing and brand image specifications

Determine what will be included in the Service Contribution Fund

If needed a separate version of this schedule could also help with planning funds for other contribution Funds. Just change the headings to reflect the categories you will need but make sure you keep the broad separation of franchisor and franchisee costs clear.

What will franchisees need to run their business that needs to be managed by you, the franchisor.

- Will your franchisees need to use your central POS or Xero or other accounting system?

- Are their other software platforms you will manage but your franchisees will use?

- How will franchisees pay for printing or uniforms or other branded goods?

You will have a specific list for your business.

What will you as franchisor need to run your business? Any use of this software by you for recruitment for instance or managing the franchisor accounts will need to be reflected clearly.

Determine what will be included for each franchisee’s initial set-up costs

Now you have a clear idea of ongoing marketing and service contributions you and your franchisees will make, you will more easily be able to work out what the set-up costs for each franchise will be.

These set-up costs will be included in the initial franchise fee and need to be accounted for in the cashflow budgets you will be doing next.

Use the same schedule you used for the Marketing and Contribution Funds to work out what will be included here. These costs are one off and so do not need to be extrapolated over the year.

Determine the franchisor establishment costs

You need to account for things such as:

- Franchising costs

- Franchise program and any additional costs to help you complete the work involved

- Trademarks

- Corporate structures

- Improvement to branding and marketing

- Additional accountant’s fees

- Recruitment promotion literature

- Recruitment costs (advertising, expos etc. media etc.and brokerage if applicable)

- Any additional staffing

- Cost of securing new premises or vehicle

Then assess any need for additional capital funding.

Action 3 – Prepare actual accounts for your existing business

Once you have the schedules for your marketing and services contributions and the franchise set-up fee worked out, you will be in a better position to start to work on the cashflow budgets for both your franchisor business and your franchisees’ businesses.

The accounts for your existing business will form the foundation of all the budgets which follow so you will start with these.

If you do not have an existing business then prepare budgets for the concept business you are planning to franchise, working on the assumption at this stage that it is just a regular business.

At this preliminary stage, be as accurate as you can with your figures as they are setting the foundation for your financial reports in the future.

This stage is not difficult, simply ask your accountant or bookkeeper to give you an accurate Profit and Loss statement for the last trading year.

Action 4 – Prepare anticipated cashflow budgets for the model franchisee business and your franchisor business and in the process, set up the fee structure for the franchise

Use the actual figures from your existing business to produce these anticipated budgets.

Working out the Fee Structures

You will work out your fee structures as you go through the budgets and the one-off fee you charge for the franchise outlet as the on-going fees will all need to be included into the budgets.

This aspect really needs to have input from a specialist franchise advisor and franchise accountant.

Depending on what you have selected, you may have access to both a franchise accountant and franchise mentor to either give you general advice or to work with you to establish these fees.

If you have this access, contact your specialists now.

It will also be useful to watch the videos of Brian discussing calculation of fees and the fees which, commercially, you need to think about including in a franchise agreement. These discussions will help you to think about the fair and reasonable things you need to cover.

It is also worth noting this content of this video where Brian discusses some things which, commercially, will be included in a franchise agreement. This sets the scene for some of the things you need to think about when working out fee structures.

Understand the budgets to be prepared

In order to produce meaningful budgeted profit and loss and budgeted cashflow statements you will also need look at your capital equipment and your working capital needs as well as running expenses and income and profit needs.

The complexity of your budgets will be determined by the range of products and services you sell and the geographic spread of your franchises. This will go even further if you intend to appoint international, national or state franchisors.

You need to prepare five critical budgets for each of the three businesses you are or are about to examine.

Again, use the spreadsheets prepared by our accountants to prepare each of the different accounts you need or get professional help.

The three businesses

The businesses are:

- Your existing business. Budgets from your existing business or concept are crucial as they will form the basis of the budgets you will be preparing for the two you are about to develop.

- A model franchisee outlet. These budgets will probably differ from your existing outlet as there will be overheads and other things which will not be applicable to the pared-down franchisee model.

- Your franchisor business. The income stream and expenditure will be closely associated with the model franchisee business but some items will be completely new. This is where you will start to work out the number of proposed franchisees being placed over the budgeted time-period.

If you anticipate there will be other levels in the franchise organization structure such as State Franchisee, then prepare the five budgets for these levels too.

Optimistic, realistic or cautious?

It’s always difficult when preparing projections. Naturally it is tempting to be optimistic – with the result that you’ll risk being disappointed. If you don’t achieve these figures, you could also fail and have cashflow challenges. Seek professional advice.

You may want to prepare three versions of your initial income and expenditure.

- Optimistic

- Realistic

- Caution

A word of warning – avoid the trap of being overly cautious and ‘black hatted’ too, because you run the risk of projecting a mediocre image. But use this version to prove up your figures. If it works in the cautious budgets it will work at all levels.

The five critical budgets

Here are the five critical budgets needed to assess the feasibility of each of your existing or new franchised business.

The Excel Guide prepared by our accountants will help with some of these budgets.

- Budget of anticipated income and expenditure through a series of profit and loss budgets. The Guide will help.

- Cashflow forecast based on your profit and loss budgets and establish working capital needs. The Guide will help.

- Finance Statement reflecting your current and proposed funding requirements. The Guide will help.

- Budget of Anticipated Capital Equipment requirements. You will need to do this on a separate excel sheet for the projected timeframe.

- Prepare a funding schedule for the group showing where and when the funds to maintain cashflow and purchase capital equipment will be accessed. Does it stack up against available funding? You will need to do this on a separate excel sheet for the same

You will then calculate the rate of return on capital after providing for realistic owner/operator wages. Again you will need to do this on a separate excel sheet for the same timeframe.

Prepare the budgets for the first 12 months

You will start by preparing your budgets for the first 12 months for each of your three businesses.

Prepare the budgets of anticipated income and expenditure through a series of profit and loss budgets

Guide 6 has been prepared by our accountants to help with this task Work out the following income streams in order:

- Recruitment and Fee budget

- Income

- Expense items

Prepare the cashflow forecasts

This is based on your profit and loss budgets and establishes working capital needs Guide 8 has been prepared by our accountants to help with this task.

Prepare the Finance Statement

This will reflect your current and proposed funding requirements. Guide 8 has been prepared by our accountants to help with this task.

Prepare the budgets of Anticipated Capital Equipment

Create a Schedule of Capital Expenditure for year one and list the items. This will provide you with your working capital needs.

Prepare the budgets of Anticipated Capital Equipment

Create a Schedule of Capital Expenditure for year one and list the items. This will provide you with your working capital needs.

Prepare a funding schedule for the group.

This will show where and when the funds to maintain cashflow and purchase capital equipment will be accessed.

Does it stack up against available funding?

Calculate the rate of return on capital

In this section you will need to consider carefully if you have provided for realistic owner/operator wages.

Look at the alternatives – for example:

- How good is your return on investment compared with the long-term interest rates available on other forms of investment?

- Does the activity generate a premium return?

- Or are you better off keeping your money in the bank?

Action 5 – Budgeted balance sheet

If you only have a budgeted profit and loss statement and budgeted cashflow statements, you’re only looking at part of the picture.

You really need a budgeted balance sheet as well.

This is so you get the full picture as it provides a check on what particular strains a profit and loss budget will put on the working capital and funding requirements for the business.

Action 6 – Extend the budgets over three to five years

When you feel comfortable you have prepared the best possible budgets for your first 12 months you can proceed to extrapolate them over a number of years. It is generally recommended a minimum of three years be applied but certainly five is a healthy number.

Re-consider how large you wish to grow your group and the rate of expansion you are projecting.

This is where you need to look at four phases of your evolution as a franchise group:

Phase One

During early growth, some of your overheads will be top-heavy because you are spending certain fixed expenditure items and cash items across a low income due to your small number of franchisees joining the system.

Phase Two

Once you’ve established yourself as a successful and attractive franchisor you can increase your recruitment marketing and accelerate recruitment. There will be a tipping point where you will be receiving much higher franchise sales revenue – which will represent optimum spread of your expenses

Phase Three

You will be approaching maturity and so maintain moderate franchisee sales revenue. This will probably also include fees for re-sales from franchisees who are selling their franchises.

This is the ideal ‘zone’ for you to reach in your business because income and expenses are fairly predictable.

Phase Four

This is where market penetration has reached close to saturation point for the time- being at least, and you will be receiving little by way of franchise sales income. You will be relying on monthly fees, re-sales and renewals and this is a break point for you. So it is essential to spend time developing your budgets for this period. The reason is, you need to ensure these income streams are sufficient to cover your projected expenses, critically to include your own salaries, research and development to keep the group on trend, your franchisor support and marketing responsibilities etc.

Have a look at some of the examples I have put together.

Action 7 – Review how this will impact on the structure of the group overall

Review your previous work

Now you have prepared all the budgets, you have the opportunity to review the work you have previously undertaken on marketing and organization structure to make sure the figures fit with your planning. This will help you determine if the amounts you used for your initial franchise fees and ongoing fees etc. have the right balance to ensure the business is profitable for everyone involved.

Look closely at:

- Pricing and the margins applied to your products and services

- Expenditure you have forecast

Are you making adequate provision for growth? Or can you comfortably defer some of the acquisitions?

These are all very important questions to be treated very seriously and analyzed closely as you finalize the design of your business structure.

The on-going need for continual review and expert assessment

Bear in mind these are projections and, after only a few months, reality may be showing a different picture.

This is why it is so important to review your projections regularly. It is not something to consider a chore but an essential exercise in growing your business.

These reviews are well suited to having someone from outside of your business join the forum to contribute their own independent views. When you think about it this makes a lot of sense because you are inevitably so deeply involved in your business you are probably in a bubble.